The 3 assets of any social network – a valuation model.

Having had the fortune of having Danah Boyd spend two full days in Sweden a few years back, sharing her extensive knowledge on Social Network history and usage with me and som colleagues, attending and following Jyri Engestrom’s talks about his social objects theory, of which I’m a big fan, and meeting with Cameron Marlow while at Yahoo, I’ve gradually started to develop some simple models of my own on how to evaluate and categorize different social networks.

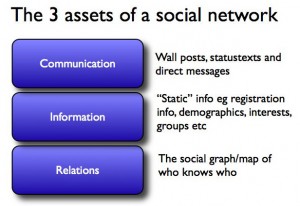

One of the models I use when looking at social networks and trying to figure out if one social network has more or less potential value than another, and where that value lies (as in “what could/should you monetize?”), is what I call the ”3 assets model”.

In my opinion, ALL social networks have these three distinct assets, from Match.com to MySpace, Flickr, Facebook , LinkedIn and Twitter. The value of (potential to monetize) the different assets differ greatly between them though.

Communication – Who has the most valuable communication asset?

That’s easy, dating is really the only type of social network that manages to monetize the communication asset, examples are Match.com. People pay to communicate on these sites. This makes perfect sense since, per definition, Match.com enables communication between two people who have no other means of communicating with each other. As a couple grow more confident with each other, they exchange contact details for other free or cheaper communication channels and churn off the service.

Monetizing the communications asset directly using ads just doesn’t work that well IMO. Random communication does not reveal intention very well, so the value will always be low. Even if you’re not working with intention based advertising, but more brand/awareness advertising, that type of advertising needs to be fairly interruptive to be valuable to buyers, which works fine for one-way services like TV, Radio etc where content can be paused during interruption, but does not rhyme well with communication and productivity tools.

There MAY be another, rather unexpected way (for me at least) to monetize the communications asset of a social network, and that is if the communication is COMPLETELY public, i.e. very much on the opposite end of the specturm from the dating site’s communication which is totally private. I’m ofcourse thinking of Twitter search. Once enough people communicate publicallly about random and temporarily popular topics, all of a sudden the sum of that creates a value for people who search through the communicaton to see what is happening on a certain topic in absolute real time, days before Google’s indexing bots find it. Search DOES reveal intention, so it could work. It remains to be seen if and how monetizable these intentions are though. I expect there to be few purchase intention searches, and lots of breaking news topic/live event searches.

Information – Who has the most valuable information asset?

In my mind, Business and professional networks like LinkedIn have the most valuable static information asset of the social networks because they are so structured on things like area of work, position (which translates to income) etc, that is is actually useful as targeting information for other sites when showing their ads, something LinkedIn is trying with NY Times. The structured information asset is also valuable to recruiters etc. I don’t know HOW valuable it will turn out to be, but it seems like the most valuable asset of the business networks to me. The communication between people on these sites is hard to monetize. XING is trying this though, with it’s premium package where you can pay to contact non-connections. But unlike a dating site, where both ppl want to be contacted by strangers, this is not true for LinkedIn and Xing, where I think the whole point is that your network works as a human filter to unsolicited messages from sales guys 🙂 Nor do I think the social graph is highly monetizable as it only contains a small vertical segment of my real life connections (i.e professional connections) which doesn’t greatly reflect who influences my purchase decisions for different products etc.

Relations – Who has the most valuable relations asset?

I definitely think Facebook’s greatest asset is it’s extensive social graph of REAL people, using their REAL identities. Unlike most of the earlier social networks where people used fake identities, that they later grow out of, Facebook is not really targeted at a specific age segment, stage of life or interest/vertical. You will be yourself your entire life, so you will not grow out of your Facebook identity. The social graph is general and represents my real life connections very well, meaning that it reflects who influences my purchase decisions in almost all different areas. Mark Zuckerberg clearly realizes this and Facebook Beacon was an unfortunate, but IMHO brilliant attempt at monetizing this social graph of influence by offering e-retailers like Amazon.com the chance spread purchase information from a user across his social graph to people who that person influences.

It should be said that Twitters social graph asset may also be valuable as it is clearly people who influence me. But I would say there is a lot more noise in this graph and a big mix between close friends and professional publishers/bloggers etc.